This is another one of those topics that have come up as off-topic diversions in a few other recent threads and that probably warrants a discussion thread of its own.

So, Bolliger and Mabillard. It (they?) is (are? OK, I'll stick with the singular from now on, as it is the name of one company) a premium coaster manufacturer if there ever was one. B&M coasters are big, thrilling, and reliable. Ever since the company started, they've been delivering really solid coasters that are landmark attractions in any park they're found in. They are premium products, and priced accordingly.

The problem is, the amusement park market has shifted a bit in recent decades. The cost of building coasters appears to have increased quite a bit since the turn of the millennium. It has become less common for parks to build really big coasters. And B&M's coasters all come in really big boxes. Even their smallest coasters, like Krake or Dæmonen, still reach heights of around 30 meters and feature (usually multiple) big inversions. They have yet to sell any of the "compact thrill" models like the Gerstlauer swing launchers or the S&S Free Spins. The Happy Valley parks bought two Family Inverted Coasters, but those are effectively the same as those offered by Vekoma for, presumably, a much lower price.

In other words, B&M offers mostly the sort of coasters that are out of range for small parks, and that large parks may consider buying once a decade or so. To make matters worse, this is a crowded market for its size, with many manufacturers offering similar coasters. B&M face competition from Intamin, Mack, Vekoma, S&S, Premier, RMC, and probably a few others I'm forgetting (is Chance Morgan around anymore?). There are even cases of Gerstlauer and Zierer dipping their toes into B&M's watering hole, and that's before we even consider what ambitions the Chinese manufacturers may have in a few years. Anyway, the difference between B&M and the aforementioned manufacturers is that the latter offer many smaller coaster models they'll happily sell to the slim-walleted customer.

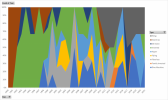

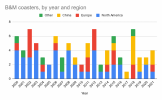

B&M make the bulk of their business in Western parks these days with their "unique selling point" coasters. They've got the market pretty much cornered on Hyper coasters, while Wing Coasters and Dive Machines also give some solid business. The 29 coasters they've built outside China since 2010 are as follows: 7 Hyper/Giga coasters, 8 Dive Machines, 8 Wing Coasters, 3 Inverted coasters, 1 Floorless coaster, and 2 Flying coasters. Effectively, in the categories they face competition (sitdown loopers, Inverts) they are barely selling any coasters at all.

However, those three most popular models are the biggest of the biggest-box coasters out there, and they are generally only sold to the biggest few parks on each continent. Those parks are starting to fill up their lineups already. Take Cedar Point, for instance. They have "one of everything" from the B&M catalog already, or something equivalent, except a Flyer. SFMM lacks a Dive Machine or something equivalent, but they probably can't afford one in any case. We're getting towards the point where the few parks that can afford to buy a B&M are lacking reasons to do so, and that's not a good market situation to be in.

Fortunately for B&M, there's China. They've sold 17 coasters to China over the past decade. Unfortunately, all but three of those have gone to startup parks. Only two Chinese parks have bought B&M coasters on two different occasions, as far as I can tell. The Chinese parks appear to be good customers, but they aren't repeat customers. They generally buy one or two B&Ms when the park is first built, and then stick with local manufacturers if the park is ever expanded. That makes B&M's business prospects in China risky at best.

So that leaves B&M in a quite precarious position. Their customer base outside China is shrinking, while in China they are dependent on new parks being built.

At the moment, RCDB only lists three B&M coasters under construction. They are the unknown Wing Coaster in Fantasy Valley, Emperor at Sea World San Diego, and Decepticoaster at Universal Studios Beijing. Only the former is actually under construction, as the other two have had their track completed and are awaiting opening. We know they are involved with the "Surf Coaster" at Sea World Orlando (but also that this park's finances are less than stellar at the moment), and they've been rumoured to be involved in Chessington's next project, but otherwise things are remarkably quiet for this prolific coaster manufacturer.

So what I'm wondering is, are things looking bleak for B&M at the moment? Or is it just a temporary dip in business? Will their business prospects improve or worsen in the coming years? I'm not too optimistic right now, frankly, but there could be some good news I haven't heard about yet.

So, Bolliger and Mabillard. It (they?) is (are? OK, I'll stick with the singular from now on, as it is the name of one company) a premium coaster manufacturer if there ever was one. B&M coasters are big, thrilling, and reliable. Ever since the company started, they've been delivering really solid coasters that are landmark attractions in any park they're found in. They are premium products, and priced accordingly.

The problem is, the amusement park market has shifted a bit in recent decades. The cost of building coasters appears to have increased quite a bit since the turn of the millennium. It has become less common for parks to build really big coasters. And B&M's coasters all come in really big boxes. Even their smallest coasters, like Krake or Dæmonen, still reach heights of around 30 meters and feature (usually multiple) big inversions. They have yet to sell any of the "compact thrill" models like the Gerstlauer swing launchers or the S&S Free Spins. The Happy Valley parks bought two Family Inverted Coasters, but those are effectively the same as those offered by Vekoma for, presumably, a much lower price.

In other words, B&M offers mostly the sort of coasters that are out of range for small parks, and that large parks may consider buying once a decade or so. To make matters worse, this is a crowded market for its size, with many manufacturers offering similar coasters. B&M face competition from Intamin, Mack, Vekoma, S&S, Premier, RMC, and probably a few others I'm forgetting (is Chance Morgan around anymore?). There are even cases of Gerstlauer and Zierer dipping their toes into B&M's watering hole, and that's before we even consider what ambitions the Chinese manufacturers may have in a few years. Anyway, the difference between B&M and the aforementioned manufacturers is that the latter offer many smaller coaster models they'll happily sell to the slim-walleted customer.

B&M make the bulk of their business in Western parks these days with their "unique selling point" coasters. They've got the market pretty much cornered on Hyper coasters, while Wing Coasters and Dive Machines also give some solid business. The 29 coasters they've built outside China since 2010 are as follows: 7 Hyper/Giga coasters, 8 Dive Machines, 8 Wing Coasters, 3 Inverted coasters, 1 Floorless coaster, and 2 Flying coasters. Effectively, in the categories they face competition (sitdown loopers, Inverts) they are barely selling any coasters at all.

However, those three most popular models are the biggest of the biggest-box coasters out there, and they are generally only sold to the biggest few parks on each continent. Those parks are starting to fill up their lineups already. Take Cedar Point, for instance. They have "one of everything" from the B&M catalog already, or something equivalent, except a Flyer. SFMM lacks a Dive Machine or something equivalent, but they probably can't afford one in any case. We're getting towards the point where the few parks that can afford to buy a B&M are lacking reasons to do so, and that's not a good market situation to be in.

Fortunately for B&M, there's China. They've sold 17 coasters to China over the past decade. Unfortunately, all but three of those have gone to startup parks. Only two Chinese parks have bought B&M coasters on two different occasions, as far as I can tell. The Chinese parks appear to be good customers, but they aren't repeat customers. They generally buy one or two B&Ms when the park is first built, and then stick with local manufacturers if the park is ever expanded. That makes B&M's business prospects in China risky at best.

So that leaves B&M in a quite precarious position. Their customer base outside China is shrinking, while in China they are dependent on new parks being built.

At the moment, RCDB only lists three B&M coasters under construction. They are the unknown Wing Coaster in Fantasy Valley, Emperor at Sea World San Diego, and Decepticoaster at Universal Studios Beijing. Only the former is actually under construction, as the other two have had their track completed and are awaiting opening. We know they are involved with the "Surf Coaster" at Sea World Orlando (but also that this park's finances are less than stellar at the moment), and they've been rumoured to be involved in Chessington's next project, but otherwise things are remarkably quiet for this prolific coaster manufacturer.

So what I'm wondering is, are things looking bleak for B&M at the moment? Or is it just a temporary dip in business? Will their business prospects improve or worsen in the coming years? I'm not too optimistic right now, frankly, but there could be some good news I haven't heard about yet.